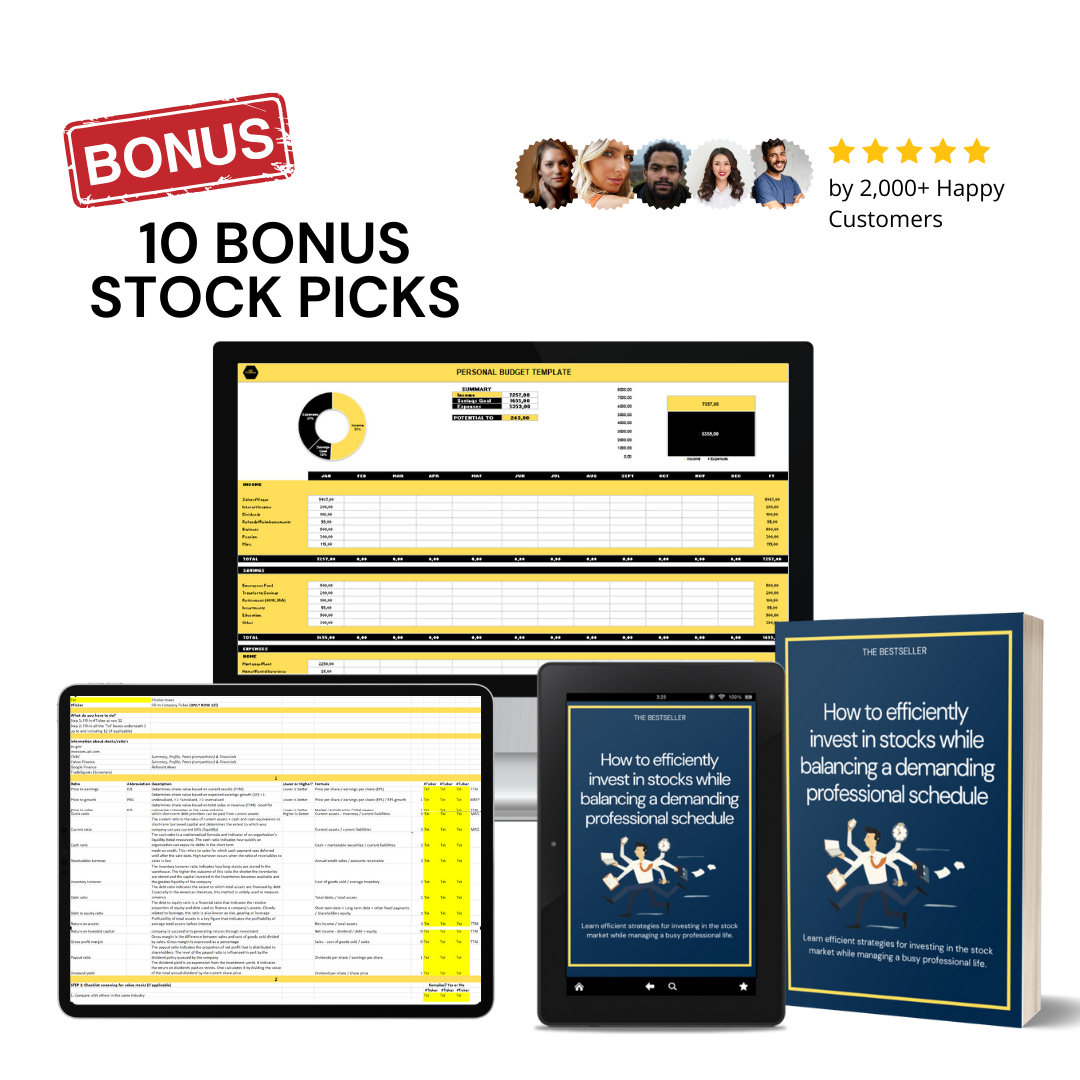

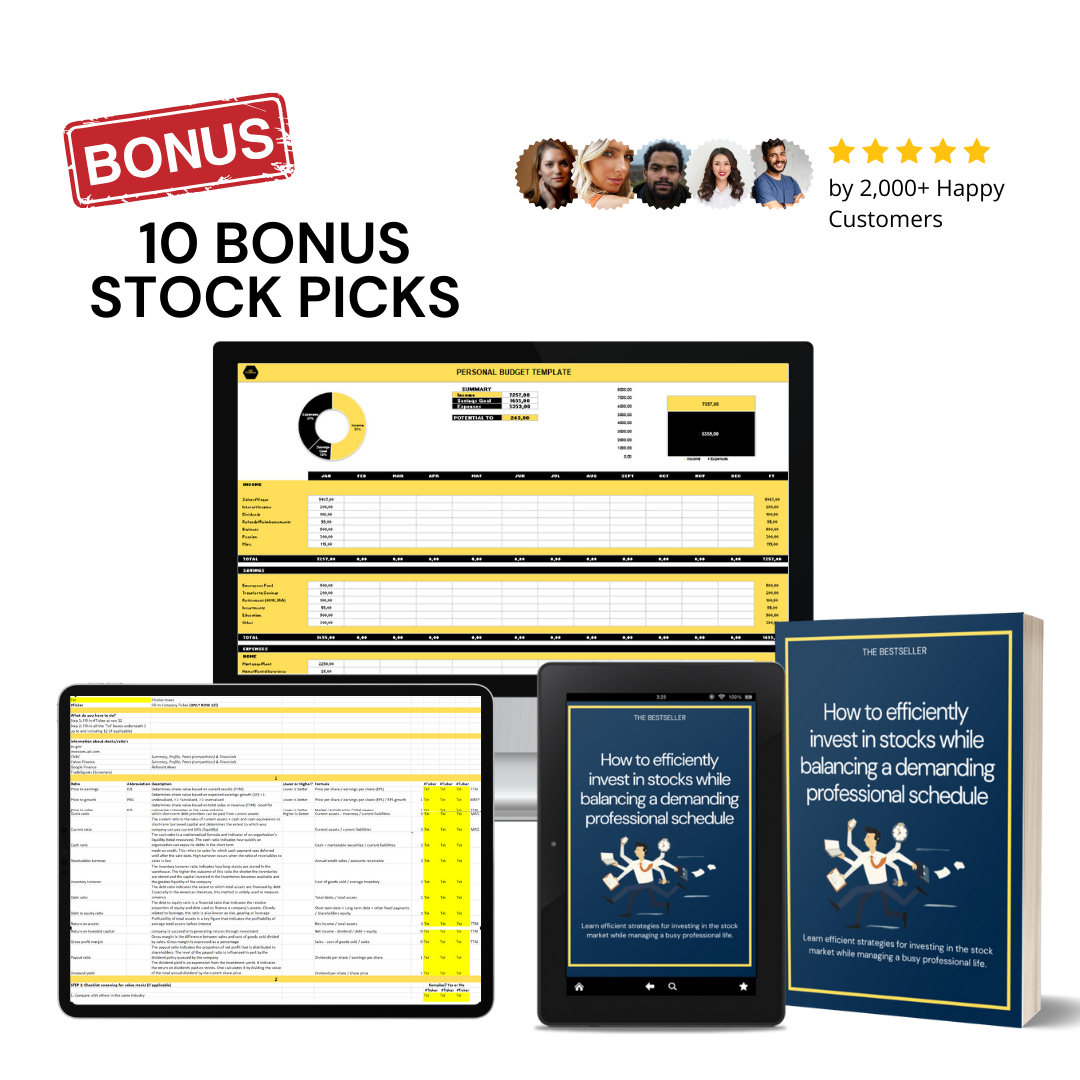

Ultimate Investment Bundle

✔ Top 10 Stocks to Buy + Detailed Analysis

✔ Guaranteed 200% ROI or Money Back!

✔ Personal Budget Template

✔ Secure Checkout - Instant Download

Worried About Missing Out on Investments?

If your busy schedule makes you feel like you're missing out on investment opportunities, you're not alone. Introducing the Complete Financial Empowerment Package, crafted specifically for For Busy Professionals like you who are eager to achieve financial success.

Unleash The Power Of Investing Today!

Unlock a comprehensive financial toolkit with in-depth analyses of the top 10 stocks, an exclusive ebook, 'Investing For Busy Professionals,' and versatile tools for stock analysis and personal budgeting. Learn Warren Buffett’s investing principles and access a detailed FAQ on financial topics. Plus, enjoy a 30-day, 100% money-back guarantee, no questions asked!

Here´s How It Works:

- Read our Ebook & In-depth analyses

- Create a brokerage account

- Get started!

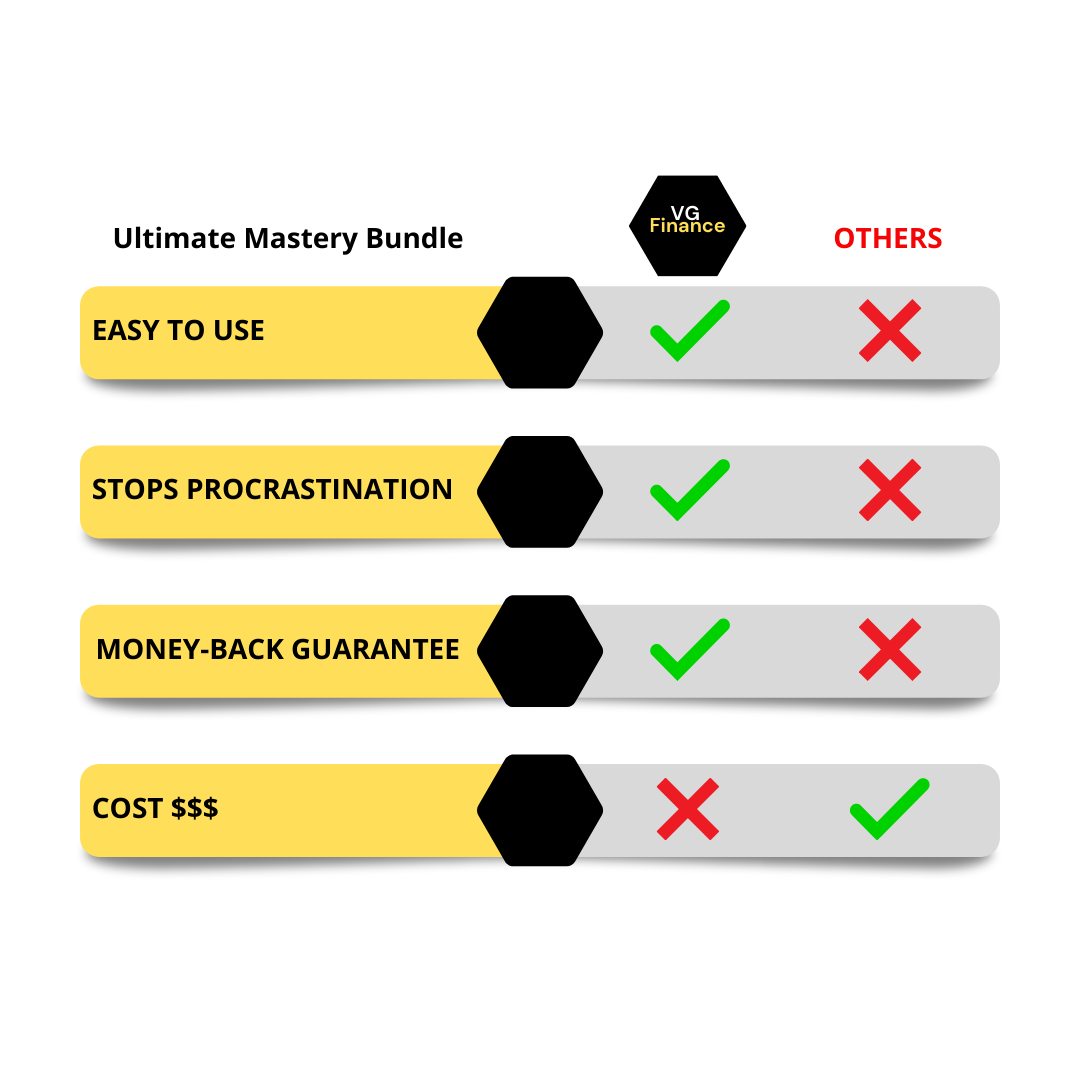

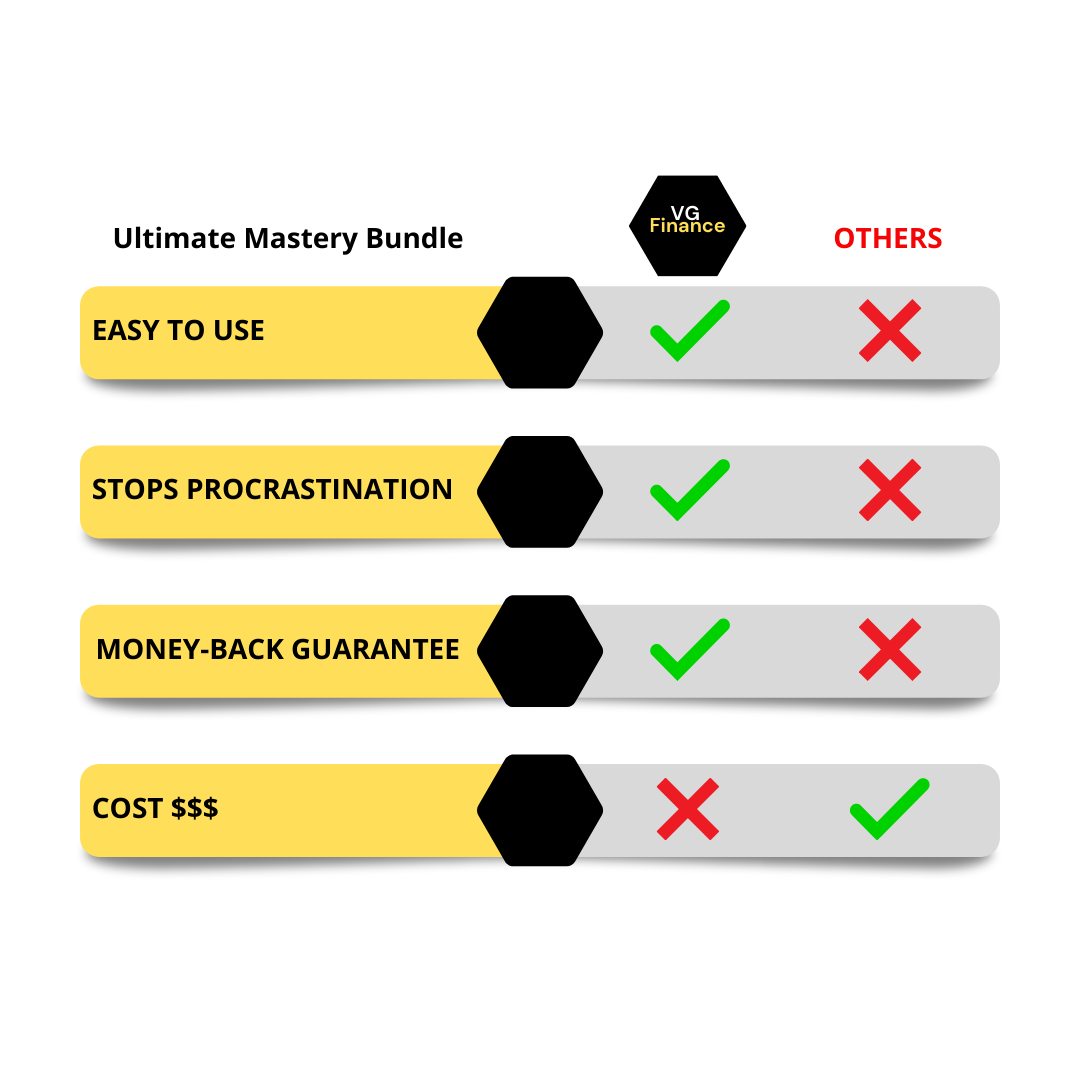

Ultimate Investment Bundle

✔ Top 10 Stocks to Buy + Detailed Analysis

✔ Guaranteed 200% ROI or Money Back!

✔ Personal Budget Template

✔ Secure Checkout - Instant Download

Here's What You'll Need:

- A Device Connected To Wifi

- A Brokerage Account

- The Ultimate Investment Mastery Bundle: Super Pro

Frequently Asked Questions

WHAT HAPPENS AFTER I PURCHASE?

After your Purchase you will receive your Ultimate Investing Mastery Bundle instantly.

WHY SHOULD I INVEST?

Investing allows you to grow your wealth over time by generating potential returns that exceed inflation rates. It offers an opportunity to achieve financial goals such as retirement, buying a home, funding education, or achieving financial independence.

IS STARTING CAPITAL NECESSARY FOR INVESTING?

No, starting capital is not necessary to begin investing. Many investment options allow for small initial investments, and fractional shares make it accessible even with limited funds. What matters most is initiating your investment journey early, regardless of the initial amount. The earlier you start, the more time your money has to grow.

HOW DO I CREATE A BUDGET?

To create a budget, track your income and expenses. Identify your essential expenses (e.g., rent, utilities, groceries) and discretionary spending (e.g., entertainment, dining out). Allocate a portion of your income for savings and investments. Ensure your total expenses do not exceed your income.

WHY IS SAVING MONEY IMPORTANT?

Saving money is crucial for financial security and achieving long-term financial goals. It provides a safety net for emergencies, helps you make major purchases, and enables you to plan for retirement.